What's new in 2025-2

Xspouse 2025-2 implements relevant legislative changes from the One Big Beautiful Bill Act (OBBBA). "Relevant legislative changes" means such changes as affect

tax computations and support calculations within Xspouse. Some of the changes take effect immediately, while others will take effect on January 1, 2026.

A PDF document that provides a detailed coverage of the changes in Xspouse (that are briefly described below), is available for download

by clicking here. Additionally, a short video titled "What's new in Xspouse 2025-2"

can be viewed on the Xspouse YouTube channel by clicking here.

New deductions

The OBBBA introduces the following below-the-line deductions, all of which are subject to various limitations as detailed in the above-mentioned PDF.

These deductions are effective immediately:

- Deduction for income received from qualified tips

- Deduction for income received from qualified overtime

- Deduction for qualified passenger vehicle loan interest

- Enhanced deduction for seniors

- Educator expenses

Note: The deductions for tips and overtime, and the enhanced deduction for seniors, are not available to married individuals filing separately (MFS).

Additionally, for those who take the Standard Deduction, the OBBBA introduces a new above-the-line deduction for charitable contributions,

which is effective from January 1, 2026, and is subject to limitations.

New data input fields have been added to the detail window for “Adjustments to income”. Use these fields to enter the full amounts of

qualified tips received, qualified overtime income, car loan interest (for qualifying vehicles), and educator expenses and Xspouse will compute the amounts of

allowable deductions.

Note: the full amounts of qualified tips and qualified overtime must be included in the relevant input fields for income

(eg, the input field for “Wages+salary”). The inputs in these new fields in the detail window for “Adjustments to income”

simply state how much of the total income entered elsewhere in Xspouse was comprised of tips and/or overtime.

The computed amounts of the deductions for tips, overtime, car loan interest, and seniors can be viewed in Xspouse in the tax form display of Form 1040, Schedule 1A

(note that the deductions will be displayed only when the year in Xspouse is toggled to 2025 or 2026, as the deductions come into effect from 2025 until 2028):

The itemized portion of educator expenses will be included in the amount that is displayed in Form 1040, Schedule A, “Other itemized deductions”

(note that the educator expenses deduction will be included only when the year in Xspouse is toggled to 2026, as the deduction comes into effect from 2026 onwards):

As mentioned, charitable contributions can be claimed as an above-the-line deduction if taking the Standard Deduction, or as an itemized deduction

if itemizing deductions. In both cases, the total amount of charitable contributions should be entered into the “Charitable contributions” input field on the main screen:

Xspouse will compute Schedule A (Itemized deductions) and will then determine whether it is better to itemize deductions, or to take the Standard Deduction.

If Xspouse determines that it is better to take the Standard Deduction together with the above-the-line deduction for charitable contributions,

then the allowable amount of the deduction will be displayed in the tax form display of Form 1040, Schedule 1

(note that the deduction will be displayed only when the year is toggled to 2026 as the deduction comes into effect from 2026 onwards).

On the other hand, if Xspouse determines that itemizing deductions is a better outcome than taking the Standard Deduction, then Xspouse will set the

“OBBBA deduction for charitable contributions (non-itemizers)” line to zero, since the above-the-line deduction cannot be taken if itemizing deductions.

In either case, the display of Schedule A will show the amount that would be allowed as an itemized deduction if itemizing deductions.

Other changes in Xspouse 2025-2

Xspouse 2025-2 also implements the following OBBBA changes:

- Standard Deduction increased, effective immediately

- Limitations on itemized deductions, effective from 2026

- New caps and phaseouts for state and local taxes, effective immediately

- Increased Child Tax Credit, effective immediately

- Changes to QBID phase-ins and minimum deduction, effective from 2026

- Changes to AMT phaseout thresholds, effective from 2026

What's new in 2025-1.1

In addition to the description below, a short video titled "What's new in Xspouse 2025-1.1" can be viewed on the Xspouse YouTube channel

by clicking here.

Year Toggles

Xspouse 2025-1 implemented the computations for the years 2024, 2025, and 2026. However, the year toggles that appear throughout Xspouse

were not displaying the correct range of years. Xspouse 2025-1.1 corrects that error and now displays the correct range of years as 2024, 2025, and 2026.

Setting bonus range and increments

In response to user requests, Xspouse 2025-1.1 adds a feature to the bonus income reports that now allows you to set the upper and lower bounds of the range

of bonus values to display, and the amount by which the bonus increases in successive rows of the table.

The bonus income reports can be accessed from the "Reports" menu on the main screen, and then selecting either "Variable Bonus Income" or "Annual Bonus".

When you then click on "Display Table", Xspouse 2025-1.1 displays the new feature above the table of bonuses. After you enter the values for the range

and increment, click on the "Refresh Table" button to apply the filter to the table.

For example, if you enter the following values into the filter, then the resultant table will display only the specified range:

This is just the first stage of enhancing the bonus income reports and, in this first stage, the same filter is shared by both the

annual and variable bonus income reports. What this means is that, when you switch between the annual and variable bonus income reports, the filter values

that you entered for one report will be retained when you switch to the other report. This is a temporary measure, and we plan to enhance the filter in

future versions of the bonus income reports.

In the meantime, if you want to be able to simultaneously view the annual and variable bonus income reports with different filter values, you can do so by

making use of the browser preview feature. For example, first select the annual bonus income report and set the filter values as desired. Then click on

the "Browser" button (located in the button bar at the foot of the page) to open the annual bonus income report in your browser. Next, select the variable

bonus income report and set the filter values as desired for that report. Then click on the "Browser" button to open the variable bonus income report

in your browser. You can now view both reports in separate tabs in your browser, with different filter values applied to each report.

You can also make use of the browser preview feature to simultaneously view bonus tables for different months in the variable bonus income report.

For example, first select the variable bonus income report and set the filter values as desired for January. Then click on the "Browser" button to

open the January variable bonus income report in your browser. Next, select February in the variable bonus income report and set the filter values as

desired for February. Then click on the "Browser" button to open the February variable bonus income report in your browser. You can now view both

reports in separate tabs in your browser, with different filter values applied to each report.

As mentioned, this is just the first stage of enhancing the bonus income reports, and we welcome continuing user feedback and suggestions for further enhancements.

What's new in 2025-1

In addition to the description below, a short video titled "What's new in Xspouse 2025-1" can be viewed on our YouTube channel

by clicking here.

Litigant labels

Xspouse 2025-1 has added the ability to enter a label for each litigant; for example, each litigant's first name.

To enter labels for litigants, go to "File" on the main menu and then "Case information". In the Case Information window, enter the labels

in the fields provided for each litigant.

If a label is provided for both litigants, the labels will be used throughout Xspouse instead of the inbuilt default labels.

Release of dependency exemptions optimized

The release of dependency exemptions has been optimized in Xspouse 2025-1 to minimize taxes. In previous versions of Xspouse, the comparison of taxes was

based on releasing all dependency exemptions vs no releases. In Xspouse 2025-1, the optimum number of dependency exemptions to release is determined, and

the number (and direction) of releases is displayed in the "Proposed" panel on the bottom center of the main screen.

Background colors

The choice of background colors has been slightly expanded and revamped. To select a background color, go to "File" on the main menu and then "Preferences".

In the Preferences window is a field in which you can choose from a range of colors for the background of Xspouse. The default is "Parchment",

but you can cycle through the color options by either repeatedly right-clicking on the field, or by clicking into the field and then using the spacebar/backspace keys.

The background won't change immediately after making a selection, but Xspouse will load with the selected color the next time that Xspouse is restarted.

What's new in 2024-1

Important Family Code changes

Xspouse 2024-1 incorporates the new changes to the Family Code that take effect from September 1, 2024.

These are major changes and are the first in decades to the Family Code. These changes include the following:

- FC §4055 (b)(3) Change in the multiplier based on total net income ranges used for calculating the K factor for child support calculations

- FC §4055 (b)(7) Change in the basis for calculating the threshold amount for the low income adjustment

- FC §4057 (b)(5) In cases where the obligor qualifies for a low income adjustment and the amount of child support established exceeds 50%,

Xspouse flags this and displays an alternative lower bound to the LIA according to the new rule

- FC §4061 (b) The method for calculating child support add-ons changes from 50/50 to that set out in this section of the code

- From September 1 an additional switch will appear in the Xspouse Settings window allowing users to revert to pre-September 1, FC rules for 2024

Revamped Federal tax display

The display of Federal tax on the Income Tax tab on the right side of the main screen has been revamped

to make it easier for users to follow the tax steps in the tax forms.

What's new in 2023-1

Windows are now centered

In previous versions of Xspouse, the main window opened in the top left corner of the screen,

and all child windows (eg, the data detail windows) also opened in the top left corner of the screen

(even if the main window had been moved to another location).

In 2023-1, the main window now opens centered on the screen and all child windows open centered on the

Xspouse main window (even if the main window is moved to another location).

California Foster Youth Tax Credit

Two fields have been added to the Party Tax Information window (under the Taxes menu) to indicate

eligibility for the California Foster Youth Tax Credit.

Form 1040, Schedule 3, Other credits

The "Other nontaxable income" data detail window has been updated to include two catch-all fields that

provide a flexible means to input the aggregate value of inputs to Form 1040, Schedule 3

What's new in 2022-1

Date of birth fields

Date of birth fields have been added in the #of children detail window

and in the Party Tax Information detail window.

Explanation of using the date of birth field for children

The detail window for entering the list of children now includes an

optional date of birth field to enable the program to automatically

determine the credits that the children qualify for based on their

ages. The credits that the children qualify for are displayed in the

#exemptions detail window.

If none of the children in the list have a date of birth entered then,

as in past years, the program assumes that all the children qualify

for all of the credits and it is up to the user to manually make any

necessary changes in the #exemptions detail window.

Note: Making manual changes to credits in the #exemptions detail

window will disable the program from automatically determining the

credits and the program will, instead, use the manually entered inputs

from the #exemption detail window, regardless of the dates that have

been entered in the children detail window.

If auto mode for determining child credits is active then an asterisk

('*') is displayed to the right of the #exemptions field. If auto

mode is disabled then no asterisk is visible. Note also that the

auto/manual mode is separate for each spouse. So it is possible to

have auto mode for one spouse (indicated by an asterisk alongside that

spouse's field) and manual mode for the other spouse (indicated by the

absence of an asterisk alongside that spouse's field)

To re-enable the program to automatically determine the credits based

on dates of birth, highlight the #exemptions field on the main screen

and press the asterisk key. An asterisk will then re-appear to the

right of the #exemptions field to indicate that automatic mode has

been re-enabled.

NOTE: RE-ENABLING AUTO MODE WILL UNDO ANY MANUALLY

ENTERED CHANGES.

While it is not mandatory to enter a date of birth for all, or any, of

the children, users are strongly urged to enter a date of birth for

every child as that will allow the program to make the most accurate

determination of eligibility for the various credits. If some

children in the list have a date of birth entered but other children

in the list don't have a date of birth entered, then their eligibility

for credits will be inferred from their position in the list relative

to children who have a date of birth entered. In that case, users

should check the #exemptions detail window and make any manual

adjustments that may be needed (but remember that making manual

changes in the #exemptions detail window will disable auto mode - see

preceding comments).

If a date of birth is entered for every child in the list then it is

not necessary to enter children in age order. If a date of birth is

entered for every child then the program will correctly re-order the

list of children (oldest to youngest) based on their date of birth.

Note, if a date of birth is entered for every child in the list

and the children are entered in the correct age order

then it is sufficient to enter just the year part of the date of birth

for the program to correctly determine child credits.

(Note: the program will not sort the list if only the year part is entered).

On the other hand, if a date of birth is not entered for every child

in the list then it is very important to enter children in age order

(oldest to youngest). If dates of birth are entered for some of the

children but the children are not entered in the correct age order,

then the children with dates of birth will be moved in the list into

the correct age order, which will affect the relative position in the

list of children with no date of birth entered (and, hence, will

affect their inferred eligibility for credits).

Revamped Schedule 8812

The IRS discontinued Pub 972 and implemented a new Schedule 8812 for tax year 2021.

The 2021 Schedule 8812 is a merger of the former Pub 972 and the old Schedule 8812.

However, for years 2022 and 2023, the tax code for Child Tax Credit reverts to the

requirements that were previously split across the former Pub 972 and the old Schedule 8812.

To cater for the differences between the 2021 Schedule 8812 and the requirements for 2022 and 2023,

Xspouse implements the differences in addtional tabs in the implementation of Schedule 8812,

with the tabs being labelled with the year to which they apply.

MFS default changed to "Std deduction"

The default method for tax deductions if status is MFS has been changed from "Itemize" to "Std deduction"

in keeping with the fact that a significant majority of households now take the standard deductions rather

than itemizing their deductions.

What's new in 2021-2

American Rescue Plan Act 2021

Xspouse has been updated for the American Rescue Plan Act 2021 changes to:

In order to implement these updates the following user interface changes have been incorporated:

- On the Taxes>Party tax information menu item an additional input has been incorporated to allow

a married individual filing separately to claim the EIC if they meet the qualifying criteria.

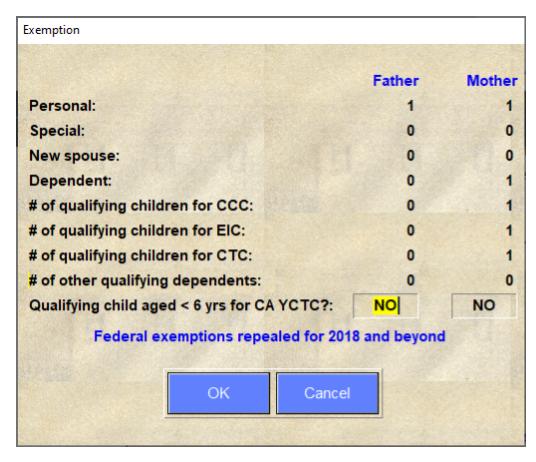

- On the Detail input window for # exemptions, where in Xspouse 2021-1 there was a YES/NO toggle to select if there

was at least one child under age 6 qualifying for the CA Young Child Tax Credit, this has been replaced with a

numerical input identifying the number of children in the row above qualifying for the CTC that are under age 6.

- For years other than 2021, where the the setting was set to YES for children under 6 qualifying for the

CA Young Child Credit, the displayed value defaults to 1. Conversely, any non-zero value entered in to

this field equates to YES for the CA Young Child Credit.

In addition to the user interface changes, the accompanying calculations steps are as follows:

Earned Income Credit

For 2021 under the no children scenario:

- the credit and phase out rates have been increased to 15.3%;

- the earned income amount when the maximum credit is reached is increased to 9,820;

- the phaseout thresholds have been increased to 11,610 (single, HH) and to 17,550 (MFJ);

- The maximum investment income allowed before the EIC cut out is $10,000 and this amount is indexed by inflation for 2022.

A background briefing of what the above steps mean is available at https://crsreports.congress.gov/product/pdf/IN/IN11610/6

Child Tax Credit

For Year 2021, the child tax credit of $2,000 per child under age 17 at the end of the year has been extended to include

children aged 17 at the end of the year. Additionally an amount of $1,600 is available for children under the age of 6

at the end of the year and an additional $1,000 for children aged 6-17 at the end of the year. Both components of the CTC

are fully refundable subject to two different phase-out rules.

The additional credit components phase-out at a rate of $50 for every $1,000 or part thereof above the following thresholds:

- $75,000 for single filers and married persons filing separate returns

- $112,500 for heads of household

- $150,000 for married couples filing a joint return and qualifying widows and widowers

The original $2,000 credit continues to be reduced by $50 for every $1,000 that modified AGI is

more than $400,000 for married couples filing a joint return and $200,000 for all others.

In order to handle the above changes, a second page has been added to the Publication 972 tax form in Xspouse that

calculates the additional credit and phase-out, then adds this amount back to Line 10 on Page 1 of Publication 972.

Further, as both components of the 2021 CTC are fully refundable, the calculation of the Additional Child Tax Credit

on Schedule 8818 has been modified for Year 2021 so that the additional credit is equal to the amount on Line 5 of Schedule 8812.

Child and Dependent Care Credit

For 2021, eligible taxpayers can claim qualifying employment-related expenses up to:

- $8,000 for one qualifying individual, up from $3,000 in prior years, or

- $16,000 for two or more qualifying individuals, up from $6,000.

The maximum percentage has been increased to 50% (up from 35%) and the phase-out threshold raised to $125,000. Above the threshold,

as previously, the percentage is decreased by 1% for every $2,000 or part thereof that the adjusted gross income exceeds the

threshold down to 20%. Thereafter, the percentage remains at 20% until a secondary threshold of $400,000 is reached above which the

percentage is again decreased by 1% for every $2,000 or part thereof that the adjusted gross income exceeds this secondary threshold,

until the credit fully phases out at an adjusted gross income over $438,000.

For 2021, the CDCC is fully refundable so the amount from Form 2441 in 2021 is written to Form 1040 Schedule 3 rather than to

Schedule 2 as in other years. A note explaining this change has been added to the bottom of Form 2441 in Xspouse.

Browser view and printing

2021-2 fixes a bug in the browser preview where, in some scenarios, the incorrect spouse label was being exported to the browser view.

What's new in 2021-1

Added Schedule D Tax Worksheet

The federal Schedule D Tax Worksheet has been incorporated into the tax calculations within Xspouse, as well as triggers to determine which worksheet to use to

calculate federal tax; ie:

- Tax Computation Worksheet, or

- Schedule D Tax Worksheet, or

- Qualified Dividends and Capital Gain Tax Worksheet

New field for pre-tax contributions to 401(k) plans

A new data input field has been added to the main screen for entering pre-tax contributions to 401(k) plans.

input field.svg)

Additional data input fields

Fields for 28% rate gain and Unrecaptured 1250 gain have been added to the detail windows for both "Other taxable income"

and "New spouse income".

Fields for lines 4e and 4g from Form 4952 have been added to the detail window for "Ded interest expense".

A field for Charitable contributions has been added to the detail window for "Adjustments to income".

More detail in display of Schedule CA (540)

The display of Schedule CA (540) under "Taxes/Tax Forms" has been significantly expanded to show more lines in Part II,

Adjustments to Federal Itemized Deductions". The expansion of this section of the display will make it much easier to see

how the figure for line 18 is calculated.

What's new in 2020

Browser preview for child(ren) timeshare

The child(ren) timeshare views can now be opened in your browser. To open the timeshare views in your browser, click

on the "Browser" button that has been added to the timeshare window in Xspouse.

The first page that will open after you click on the "Browser" button in Xspouse will be the list of children.

An ellipsis (...) beside a child's name indicates that more information is available by clicking on the ellipsis.

For example, if the child's timeshare was set using the "Table" option, then clicking on the ellipsis beside that

child's name will show which option in the table was selected for the child.

Similarly, if the child's timeshare was set using the "Worksheet" option, then clicking on the ellipsis beside that

child's name will display the worksheet for that child.

The browser display is interactive and you can click on any month or either parent to see that month's and/or parent's

data.

Printing a worksheet from the browser will allow you to choose whether to print just this month for the currently selected

parent (this is the default print setting), or to print all months and/or print for both parents.

Changed settings are cleary identified

In order to make it easier for the user to identify which settings have been changed, all settings that trigger the “Settings changed” warning on the main screen

are now displayed in red font in the Settings window when changed from those shipped with the program.

If a setting is changed back to the Xspouse default, then its font returns to black. That makes it very easy in the Settings screen to identify which settings have been changed.

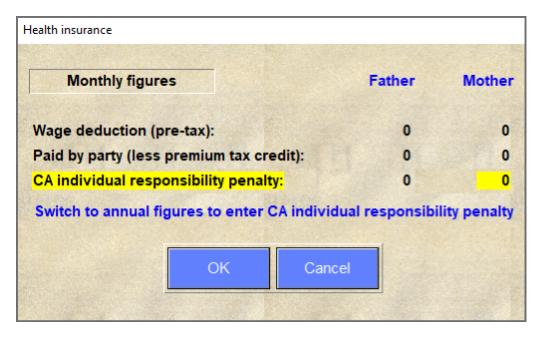

Health insurance detail window

In the Health insurance detail window, with the removal of the federal individual responsibility payment, the federal input has been simplified by having the user enter

the net payment after the premium tax credit has been accounted for. At the same time, with the introduction of a state based individual responsibility penalty,

provision is included for entering the penalty.

Young Child Tax Credit

California has introduced a Young Child Tax Credit if a qualifying child is under the age of 6 years. A YES/NO toggle is provided in the detail input window for #Exemptions

to indicate this. The default is NO.

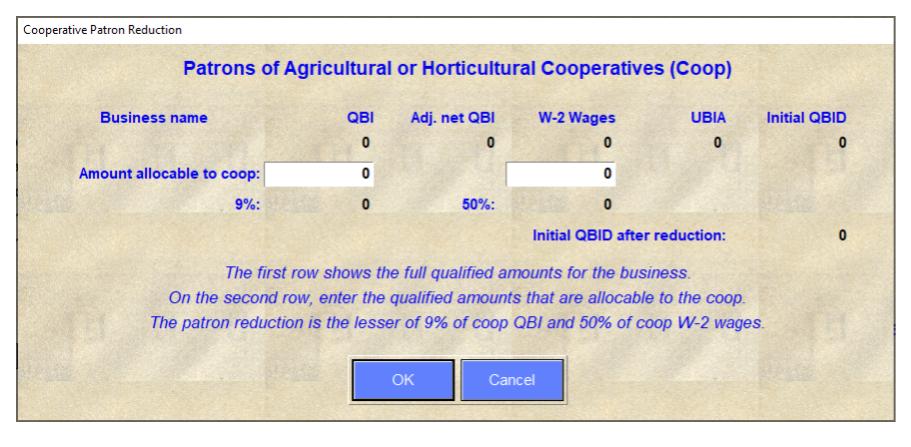

QBI coop patron reduction

An additional option has been included on the QBID calculator to allow for a coop reduction.

A subwindow opens up on pressing the Coop button to allow the required input.

What's new in 2019

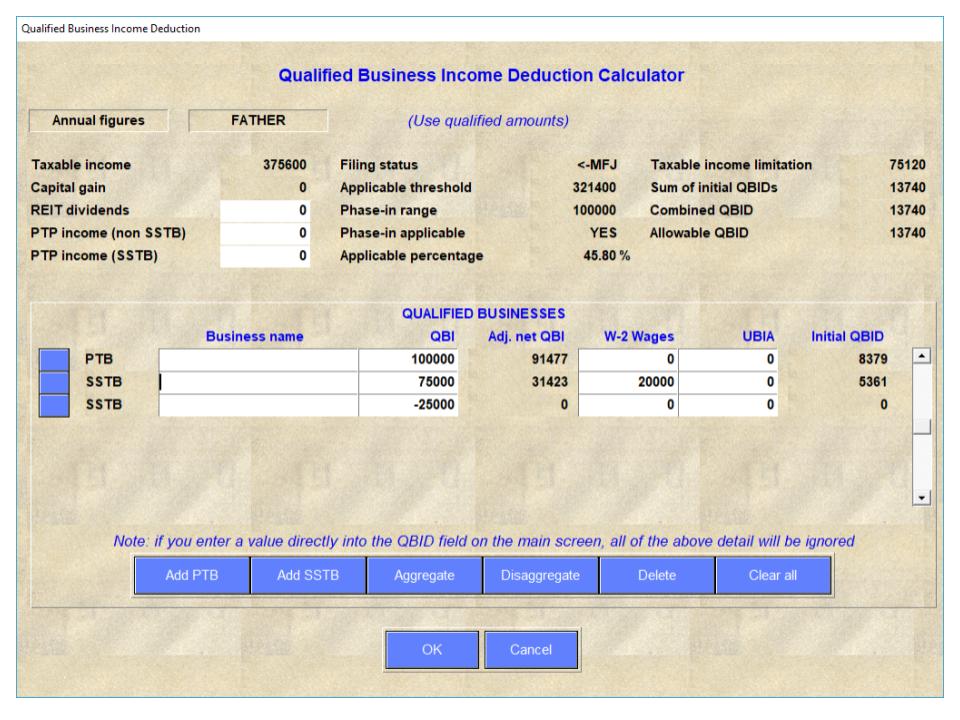

Qualified Business Income Deduction Calculator

Xspouse 2019 provides a fully-integrated qualified business income deduction calculator that is accessible via the detail window for the "Qual bus income ded" field

on the main screen. As with other input fields on the main screen, a value for QBID can be entered directly into the field, or the QBID value can be computed by

opening the detail window to display the QBID calculator, and entering the qualified amounts for QBI, W2-wages, and UBIA.

The calculator provides buttons for adding and deleting PTBs and SSTBs, and for aggregating/disaggregating PTBs. The QBID calculator automatically takes the filing status,

taxable income, and capital gain information from the currently open case in order to calculate the various parameters, such as the applicable threshold, phase-in range,

applicable percentage, and others.

If businesses with a negative QBI are added, the calculator automatically follows the netting rules set out in the regulations.

If a QBID value is entered directly into the "Qual bus income ded" field on the main screen, any data that had previously been entered into the QBID calculator will be

ignored (but not deleted). If the calculator is subsequently re-opened, and the 'OK' button clicked, then the QBID value that is computed by the calculator will again

replace any value that had been entered directly into the field on the main screen.

Taxable/non-taxable, deductible/non-deductible spousal support

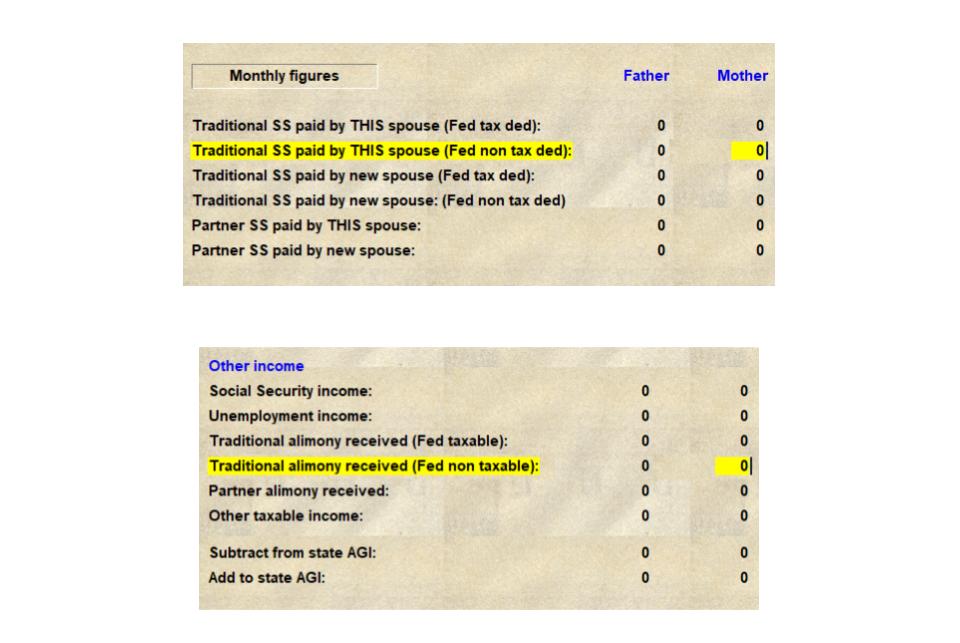

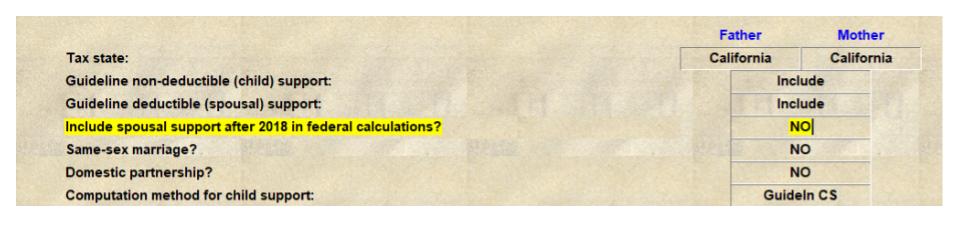

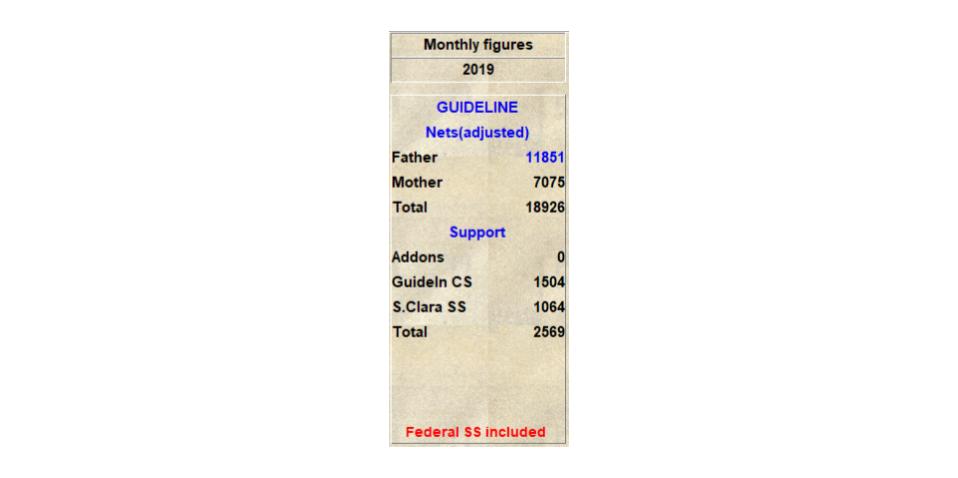

Xspouse 2019-1 builds on Xspouse 2018-1.1 in treating spousal support judgements post 2018 as being non-tax items federally, and treated as adjustments to income for state taxes.

In conformance with the new FL-150, Xspouse 2019-1 includes new input fields for taxable and non-taxable spousal support payment

in the detailed input windows under “SS paid prev marriage” and “Other taxable income”.

Additionally, a switch has been added to the Settings screen to allow activation of federal tax for spousal support, if required.

If this switch is set to “YES”, a new warning message is displayed on the main Xspouse screen to indicate this fact.

Note: The default in Xspouse is 'NO', as this conforms to the federal tax changes.